Page 27 - of Khadrun’, and that Mark said about the lineage of Jesus son of Mary that he was 'The word of God which He placed in the human body, so it became human’, and that Luke said, 'Jesus son of Mary and his mother were humans of flesh and blood, so the Ho

P. 27

Investor Guide to Iraq 2021

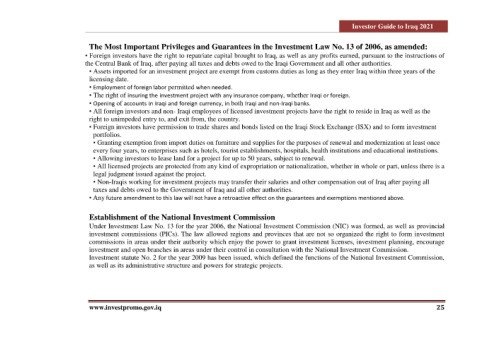

The Most Important Privileges and Guarantees in the Investment Law No. 13 of 2006, as amended:

• Foreign investors have the right to repatriate capital brought to Iraq, as well as any profits earned, pursuant to the instructions of

the Central Bank of Iraq, after paying all taxes and debts owed to the Iraqi Government and all other authorities.

• Assets imported for an investment project are exempt from customs duties as long as they enter Iraq within three years of the

licensing date.

• Employment of foreign labor permitted when needed.

• The right of insuring the investment project with any insurance company, whether Iraqi or foreign.

• Opening of accounts in Iraqi and foreign currency, in both Iraqi and non-Iraqi banks.

• All foreign investors and non- Iraqi employees of licensed investment projects have the right to reside in Iraq as well as the

right to unimpeded entry to, and exit from, the country.

• Foreign investors have permission to trade shares and bonds listed on the Iraqi Stock Exchange (ISX) and to form investment

portfolios.

• Granting exemption from import duties on furniture and supplies for the purposes of renewal and modernization at least once

every four years, to enterprises such as hotels, tourist establishments, hospitals, health institutions and educational institutions.

• Allowing investors to lease land for a project for up to 50 years, subject to renewal.

• All licensed projects are protected from any kind of expropriation or nationalization, whether in whole or part, unless there is a

legal judgment issued against the project.

• Non-Iraqis working for investment projects may transfer their salaries and other compensation out of Iraq after paying all

taxes and debts owed to the Government of Iraq and all other authorities.

• Any future amendment to this law will not have a retroactive effect on the guarantees and exemptions mentioned above.

Establishment of the National Investment Commission

Under Investment Law No. 13 for the year 2006, the National Investment Commission (NIC) was formed, as well as provincial

investment commissions (PICs). The law allowed regions and provinces that are not so organized the right to form investment

commissions in areas under their authority which enjoy the power to grant investment licenses, investment planning, encourage

investment and open branches in areas under their control in consultation with the National Investment Commission.

Investment statute No. 2 for the year 2009 has been issued, which defined the functions of the National Investment Commission,

as well as its administrative structure and powers for strategic projects.

www.investpromo.gov.iq 25